1. Understanding climate risk and insurability

Insurance that covers climate damage is crucial to support affected communities and community members in their long-term and short-term financial and emotional recovery.

Likewise, it is extremely important that community service organisations secure sufficient and efficient insurance to ensure a quick recovery after a disaster, as many community members depend on their services, programs and support.

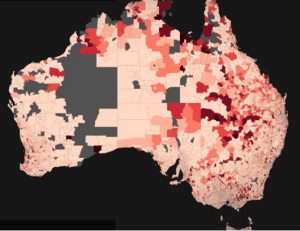

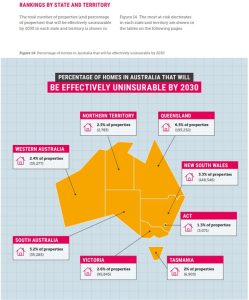

However, some areas of Australia will become uninsurable by 2030, as the report Uninsurable Nation Report highlights.

(Source: Marketforces)

2. Case study

The 2019-2020 Australian bushfire season, often referred to as the “Black Summer,” is a prominent case study that illustrates the significant impact of climate change on insurance. This case study highlights the dramatic effects of extreme weather events on insurance affordability and availability, as well as the advocacy efforts to address these challenges.

Impact on Insurance:

- Increased Premiums: Insurers faced substantial losses due to the bushfires, leading to sharp increases in premiums for those in affected areas. For instance, homeowners in bushfire-prone regions of New South Wales saw their premiums rise by up to 30%.

- Coverage Reductions: Some insurers began to limit or exclude coverage for properties in high-risk areas. This left many homeowners struggling to secure or afford insurance.

- Insurance Withdrawals: Several insurers withdrew from high-risk areas altogether, exacerbating the problem of uninsurability.

(Sources: Affordability, Insurance Council Australia, Uninsurable Nation, Climate Council, Weathering the Storm, Climate Council)

3. Financial rights – Mob Strong Debt Help

Mob Strong Debt Help is a free nationwide service that offers legal advice and financial counselling specifically for Aboriginal and Torres Strait Islander Peoples. This service plays a crucial role in supporting individuals and families facing financial challenges, such as debt, money problems, and issues related to insurance and superannuation.

In the context of climate justice, financial stability is essential for communities impacted by environmental changes. Climate change disproportionately affects Aboriginal and Torres Strait Islander Peoples, often leading to increased financial stress and economic inequality. Mob Strong Debt Help aims to empower these communities by providing them with the necessary tools and support to manage their financial situations effectively.

By exploring the topics listed below, users can find valuable information tailored to their needs. For immediate assistance, Mob Strong Debt Help encourages individuals to call 1800 808 488, reinforcing the message that they are not alone in their financial journey.

4. Engaging in climate insurance advocacy

It is important that community service organisations engage in discussions and advocacy to support an equitable shift in insurance policies, affordability, and availability. ABC Radio in Perth has hosted a panel discussion, “Spotlight on the high cost of insurance”, which can help understand the importance and complexities of Climate Insurance. Discussing climate and insurance realities and fears with your Lived Experience Advisory Group and Aboriginal and Torres Strait Islander Peoples Advisory group can help to inform your advocacy approach and actions.

5. Insurance advocacy steps for community service organisations

Develop advocacy strategies:

- Assess Needs: Identify insurance needs with your Lived Experience Advisory Group and Aboriginal Steering Group, especially for high-risk areas.

- Make Suggestions: Propose improvements for climate-sensitive insurance.

- Engage Stakeholders: Connect with officials, insurers, and advocacy groups.

- Run Campaigns: Raise awareness about climate impacts on insurance.

Build partnerships:

- Collaborate: Work with other community groups and insurance experts.

- Join Networks: Be part of climate and insurance networks.

- Engage Insurers: Build relationships to find solutions.

Create insurance literacy programs:

- Educate: Offer workshops and resources on insurance and climate risks.

- Assist: Help individuals review their insurance.

Advocate for policy vhanges:

- Join Discussions: Engage in policy talks for better insurance policies.

- Support Innovation: Promote new insurance solutions for climate risks.

(Source: Uninsurable Nation Report)

6. Definition of key terms

Climate risk: The potential for adverse effects on people, property, and ecosystems due to changes in climate patterns, such as increased frequency of extreme weather events, rising sea levels, and temperature fluctuations.

Insurability: The ability to obtain insurance coverage for specific risks. This depends on factors like the likelihood of a risk occurring, the potential severity of its impact, and the insurer’s willingness to cover those risks.

Climate-sensitive insurance policies: Insurance policies are designed to address risks associated with climate change, such as coverage for damages from extreme weather events or support for communities affected by climate-related disasters. These policies often include provisions to adapt to evolving climate risks and promote resilience.

Read more

Broken Insurance Market Failing to Protect People in Climate Crisis: New Report (Climate Council)

Weathering the Storm: Insurance in a changing climate (Climate Council)

Inquiry into insurers’ responses to 2022 major floods claims (Parliament of Australia)

Financial preparedness tips (Ready)

Microinsurance company’s evacuation insurance against disasters (Prevention Web)

Insurance “red zones” spread across Australia. Insurers making it worse (Marketforces)